How to Pay off Debt Faster?

Debt can be a significant source of financial stress and can hinder your ability to achieve your long-term financial goals. In this article, we will guide you through the steps to pay off debt and pave the way to financial freedom.

1. Assess Your Debt

- Take stock of all your debts, including credit cards, loans, and outstanding balances.

- List them out, noting the interest rates, minimum payments, and total amounts owed.

2. Create a Budget

- Track your income and expenses to understand your cash flow.

- Create a realistic budget that allocates enough funds to cover your debt payments while still allowing for essential expenses.

3. Prioritize and Strategize

- Identify high-interest debts and prioritize them for early repayment.

- Consider strategies like the debt avalanche (paying off highest-interest debts first) or the debt snowball (paying off smallest debts first for motivation).

4. Cut Expenses

- Trim unnecessary expenses from your budget, such as dining out, entertainment, or subscriptions.

- Consider more cost-effective alternatives for daily expenses like groceries or transportation.

5. Increase Income

- Explore ways to boost your income, such as taking up a side hustle or freelance work.

- Use the extra earnings to accelerate debt payments.

6. Negotiate Lower Interest Rates

- Contact your creditors to negotiate lower interest rates on your debts.

- Highlight your commitment to repayment and your willingness to explore alternatives if necessary.

7. Consolidate Debt

- Explore debt consolidation options, such as transferring high-interest credit card balances to a lower-interest loan or a balance transfer credit card.

- Consolidating your debts can simplify repayment and potentially reduce overall interest charges.

8. Utilize Windfalls and Extra Funds

- Put unexpected income, tax refunds, or bonuses towards your debt.

- Avoid the temptation to splurge and instead use these windfalls to make significant debt payments.

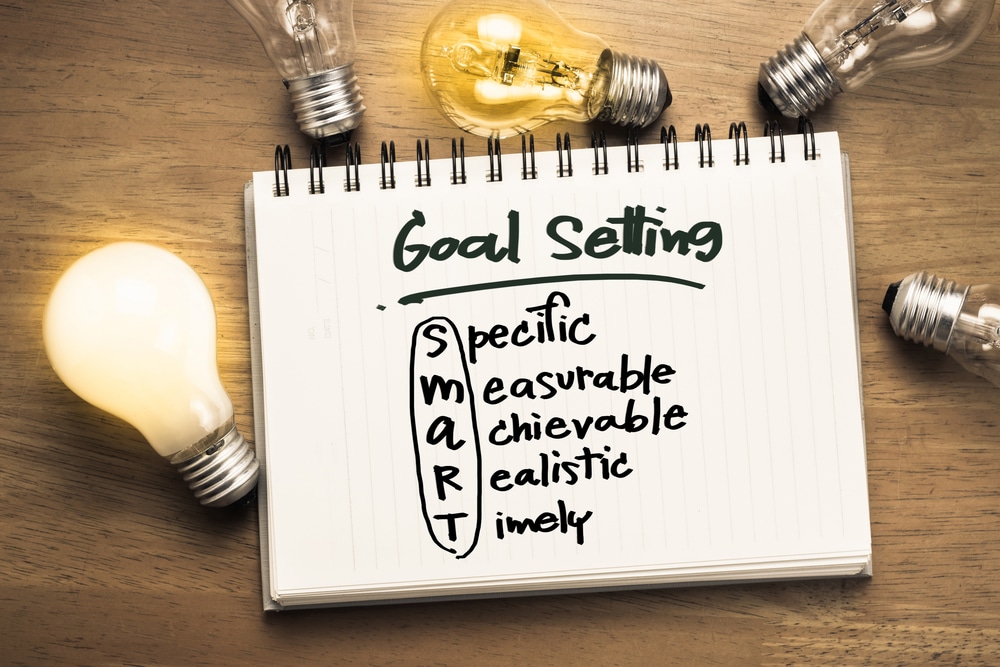

9. Stay Motivated and Celebrate Milestones

- Track your progress and celebrate each debt milestone you achieve.

- Set mini-goals along the way to maintain motivation throughout the debt repayment journey

10. Seek Professional Help if Needed

- If you’re struggling to manage your debt on your own, consider consulting with a reputable credit counselor or financial advisor.

- They can provide expert guidance, help you explore debt repayment options, and develop a personalized plan to achieve financial freedom.

Becoming debt-free and achieving financial freedom requires discipline, perseverance, and a strategic approach to debt repayment. By following these steps and staying committed to your goals, you can pay off your debts, regain control of your finances, and pave the way towards a brighter financial future.